Admission of a new partner Class 12 ISC and CBSE important 2023

Chapter 1- Company Accounts Financial Statements of Not-for-Profit Organisations. Chapter 2- Accounting for Partnership Firms- Fundamentals. Chapter 3- Goodwill- Nature and Valuation. Chapter 4- Change in Profit - Sharing Ratio Among the Existing Partners. Chapter 5- Admission of a Partner. Chapter 6- Retirement/Death of a Partner.

Admission of Partner Class 12th Day12 YouTube

Solution: Question 12. A, B, C and D are in partnership sharing profits and losses in the ratio 36:24:20:20 respectively. E joins the partnership for 20% share and A, B, C and DS in future would share profits among themselves as 3/10:4/10: 2/10:1/10. Calculate new profit- sharing ratio after E's admission.

Class 12 Accounts Ch 5 Admission of Partner Full Ch Concept & Illustrations (Part 2) (202223

T. S. Grewal Solutions for Class 12-commerce Accountancy CBSE Chapter 5: Get free access to Admission of a Partner Class 12-commerce Solutions which includes all the exercises with solved solutions. Visit TopperLearning now!

Admission_of_a_Partner_class_12 Account Ch 5 GSEB ENGLISH MEDIUM illustration 18 YouTube

TS Grewal Solutions for Class 12 Accountancy Chapter 5 - Admission of a partner is considered to be an essential concept to be learnt completely by the students. Here, we have provided TS Grewal Accountancy solutions for class 12 in a simple and a step by step manner, which is helpful for the students to score well in their upcoming board.

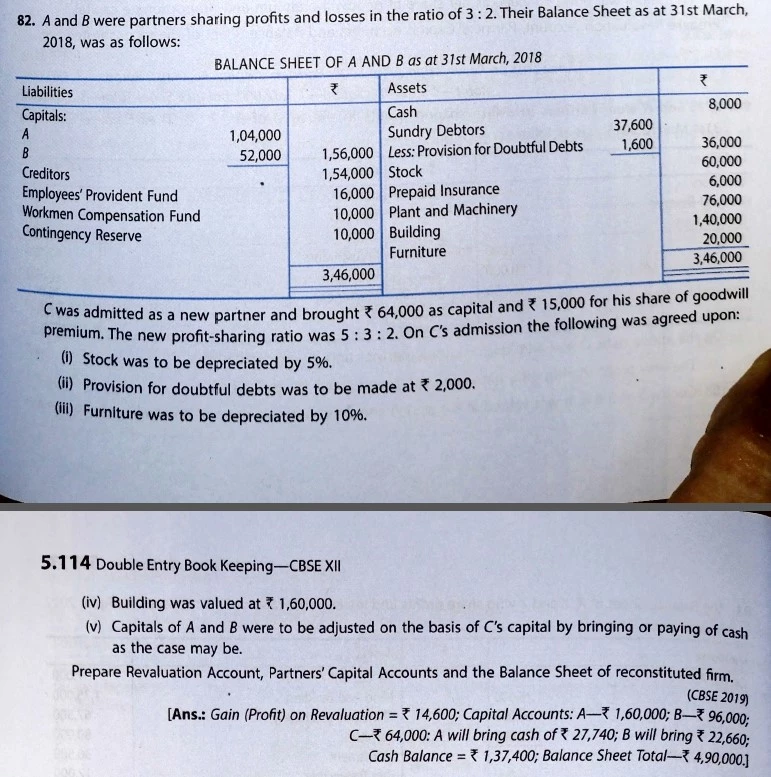

[CBSE] Q. 82 Solution of Admission of Partner TS Grewal Accounts Class 12 (202223)

Define admission of partners. Answer: Admission of a partner is a mode of reconstituting the firm because, with the admission of a partner, the existing agreement ends and new agreement among all the partners comes into force. QUESTION 2 According to section 31 of the Indian Partnership Act, 1932, when can a person be admitted as a new partner?

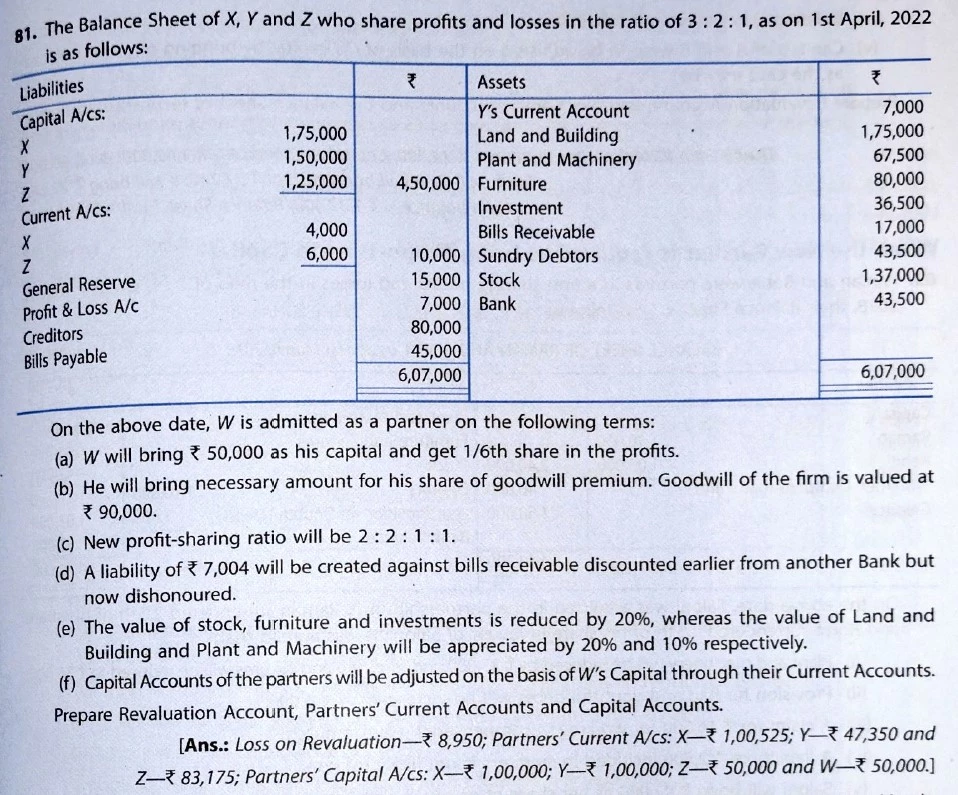

[CBSE] Q. 81 Solution of Admission of Partner TS Grewal Accounts Class 12 (202223)

The Indian Partnership Act, 1932 mandates the approval of the existing partners when a new partner is admitted. TS Grewal accountancy class 12 chapter 5 solutions 2023 provides more insight on the subject. Admission of a partner class 12 TS Grewal Solutions 2023 effectively answers all common questions on this topic. 2.

Admission of a new partner 12 th class YouTube

Previous Video: https://www.youtube.com/watch?v=N1Q8ZLDwpKcNext Video: https://www.youtube.com/watch?v=nW74UK4yVYw ️📚👉 Get All Subjects playlists:- https:.

Class 12 Chapter 5 Admission of partner TS Grewal 2021 solutions for question 16, 17 and

Available here are Chapter 5 - Admission of a Partner Exercises Questions with Solutions and detail explanation for your practice before the examination. CBSE Commerce (English Medium) Class 12. Question. Get the free view of Chapter 5, Admission of a Partner Class 12 Accountancy - Double Entry Book Keeping Volume 1 additional questions for.

Admission of a Partner Class 12 Revision Notes Leverage Edu

Are You looking for the solutions of chapter 5 Admission of Partner of TS Grewal Book Class 12 Accountancy 2022-23 Edition CBSE Board? I have solved each and every question of the 5th chapter of TS Grewal Book of latest 2022-23 Editon for CBSE Board. The link to All unsolved questions has been given below.

Class 12 Admission Of Partner (Day 18) 25052020 YouTube

June 20, 2022. T.S Grewal Solutions (12) 7. Share your love. Are You looking for the solutions of chapter 5 Admission of Partner of TS Grewal Book Class 12 Accountancy Book 2021-22 Edition? I have solved each and every question of the 5th chapter of TS Grewal Book of latest 2021-22 Editon. The link to All unsolved questions has been given below.

!ADJUSTMENT OF CAPITAL! Admission of a Partner. class 12. YouTube

TS Grewal Accountancy Class 12 Solutions Chapter 5 - Admission of a partner is considered to be an essential concept to be learnt completely by the students. Here, we have provided TS Grewal Accountancy solutions for class 12 in a simple and a step by step manner, which is helpful for the students to score well in their upcoming board examinations.

Admission of a Partner Class 12 Introduction Chapter 5 CA Foundation Part 1 YouTube

Q. 66 Solution of Chapter 5 Admission of Partner Accountancy Class 12 TS Grewal Book 2021-22. Are you looking for the solution to Question number 66 of the Admission of partner chapter 5 of TS Grewal Book 2021-22 Edition for the 2021-22 session? Question number 66 of chapter 5 of Admission of a partner chapter is a practical one.

Class 12 Introduction Admission of Partner Ep. 1 YouTube

GSEB Solutions Class 12 Accounts Part 1 Chapter 5 Admission of a Partner April 23, 2023 / By Bhagya / Class 12 Gujarat Board GSEB Textbook Solutions Class 12 Commerce Accounts Part 1 Chapter 5 Admission of a Partner Textbook Exercise Questions and Answers. Gujarat Board Textbook Solutions Class 12 Accounts Part 1 Chapter 5 Admission of a Partner

Admission of a partner class 12 part 3 YouTube

Ts Grewal Solutions Chapter 5 - Admission of a Partner. Ts Grewal 2019 Solutions for Class 12 Chapter 5 Admission of a partner are provided here. All questions and Solutions from the Double Entry Book Keeping Ts Grewal 2019 Book of Class 12 Accountancy Chapter 5 Admission of a partner are provided here for you for free.

Admission of Partner Class 12/ 3rd lecture Ratio Explained YouTube

The 12th standard accountancy is divided into three different books: partnership, companies, and management accounting concepts. The partnerships book carries the most weightage and teaches many important aspects of accounting principles in a partnership firm.

Adjustment of Capital Unsolved QA Admission of a Partner Ch 5 Class 12

When a new partner joins an existing partnership, it is termed as the 'Admission of a Partner'. The entry of a new partner brings about various changes in the profit-sharing ratio, capital, and assets of the partnership firm. TS Grewal Class 12 Chapter 5 delves deep into understanding these changes. New Profit Sharing Ratio (PSR)